Choosing the right health insurance can feel overwhelming, but it’s a crucial step toward securing your well-being. Did you know that nearly 61% of Americans rely on group plans provided by their employer? These options often come with competitive premiums and comprehensive coverage, making them a popular choice.

However, personal insurance policies are also gaining traction, especially for those seeking flexibility. With rising costs and evolving health care needs, understanding the differences between these options is essential. Our guide dives into eligibility, costs, benefits, and future trends to help you make an informed decision.

Whether you’re exploring group or personal plans, we’re here to simplify the process. Let’s navigate this journey together and find the best fit for your unique needs.

Key Takeaways

- Over 60% of Americans rely on group health insurance plans.

- Personal insurance offers flexibility for those with unique needs.

- Understanding costs and benefits is key to choosing the right plan.

- Our guide provides insights into eligibility and future trends.

- Make an informed decision to secure your health and financial well-being.

Introduction to Health Insurance Options in the US

Navigating the world of health coverage can be complex, but it’s essential for our well-being. With rising medical expenses and evolving healthcare needs, understanding your options is more important than ever. Whether you’re part of a group plan or exploring individual policies, the right choice can make a significant difference in your life.

Context and Importance in Our Lives

Health insurance is more than just a safety net—it’s a cornerstone of our overall well-being. It protects us from unexpected medical costs and ensures access to quality care. For many, being part of a group plan through their employer provides stability and affordability. However, individual policies offer flexibility for those with unique needs.

Our choices today shape our future. By understanding the nuances of coverage, we can make decisions that align with our health and financial goals. Let’s explore how these options impact our lives and what we can do to secure the best possible care.

Our Evolving Healthcare Environment

The healthcare landscape is constantly changing. Rising premiums and deductibles have made it challenging for many to afford adequate coverage. Employers and employees often share these costs, creating a partnership that influences the quality of care we receive.

Here’s a quick comparison of group and individual plans:

| Aspect | Group Plans | Individual Plans |

|---|---|---|

| Cost Sharing | Employer and employee contributions | Fully paid by the individual |

| Flexibility | Limited to employer options | Customizable to personal needs |

| Coverage Scope | Comprehensive, often includes family | Tailored to individual or family needs |

As we navigate these changes, staying informed is key. By understanding the differences between group and individual plans, we can make choices that prioritize our health and financial stability.

Overview of Group Health Insurance and Individual Health Plans

Understanding your health coverage options is the first step toward financial and medical security. Whether you’re part of a group plan or exploring individual policies, each option offers unique advantages tailored to different needs. Let’s break down the key features of both to help you make an informed decision.

What is Employer-Sponsored Group Health Insurance?

Group plans are typically offered by employers and provide coverage for employees and their families. These plans often come with cost-sharing mechanisms, where both the employer and employee contribute to premiums. This setup can make group plans more affordable compared to individual policies.

Eligibility is usually tied to employment status, and the benefit packages are comprehensive, often including preventive care, prescription drugs, and mental health services. According to KFF, nearly 61% of Americans rely on these plans for their coverage.

Understanding Individual Health Insurance Plans

Individual plans, on the other hand, are purchased directly by consumers through public or private exchanges. These plans offer more flexibility, allowing you to customize coverage based on your specific needs. The Affordable Care Act (ACA) plays a significant role in making these plans accessible, especially for those with lower income levels.

One of the key advantages of individual plans is the availability of subsidies, which can reduce premium costs. Additionally, these plans often provide tax advantages, making them an attractive option for many families.

“Choosing the right plan is about balancing cost, coverage, and flexibility to meet your unique needs.”

Here’s a quick comparison of group and individual plans:

| Aspect | Group Plans | Individual Plans |

|---|---|---|

| Cost Sharing | Employer and employee contributions | Fully paid by the individual |

| Flexibility | Limited to employer options | Customizable to personal needs |

| Coverage Scope | Comprehensive, often includes family | Tailored to individual or family needs |

| Tax Advantages | Employer contributions are tax-free | Subsidies and tax credits available |

By understanding the differences between group and individual plans, you can choose the option that best aligns with your financial and healthcare needs. Whether you prioritize affordability or flexibility, the right plan is out there for you and your family.

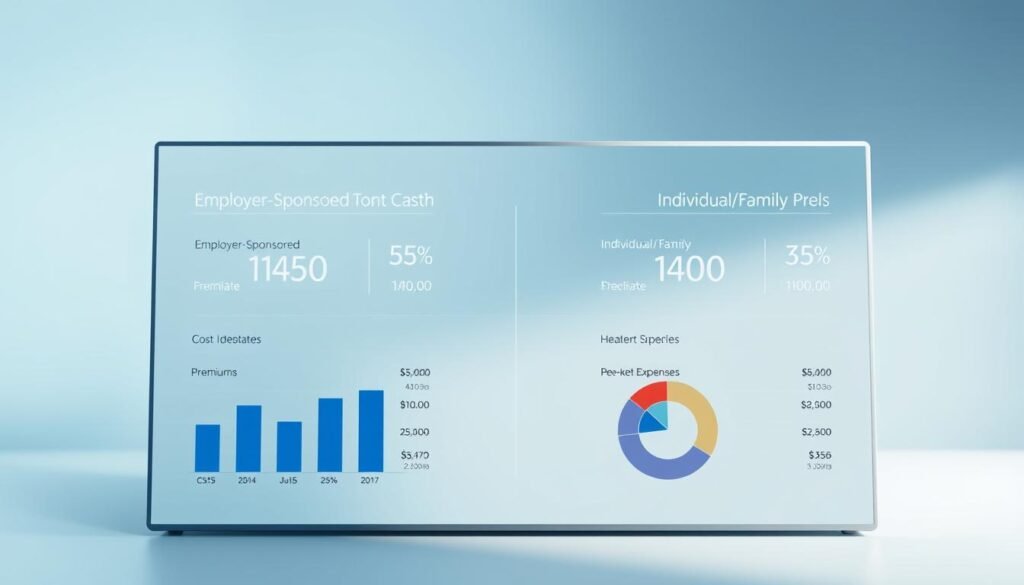

Employer-Sponsored vs. Individual & Family Health Plans in the US

Exploring health coverage options can lead to better financial and medical security. Understanding the key features and eligibility criteria of different plans is essential for making an informed choice. Let’s dive into the specifics of group and individual policies to help you decide what works best for your needs.

Key Features of Group and Individual Plans

Group plans, often provided by employers, come with shared costs between the employer and employee. This setup typically includes lower premiums and comprehensive coverage. On the other hand, individual plans offer more flexibility, allowing you to tailor the policy to your specific needs.

One of the standout features of group plans is the contribution model, where both parties share the financial burden. Individual plans, however, are fully funded by the policyholder, which can be offset by subsidies or tax credits.

Eligibility and Policy Variations

Eligibility for group plans is usually tied to employment status, making them accessible to full-time employees. Individual plans, in contrast, are available to anyone, regardless of their job situation. This makes them a viable option for freelancers, part-time workers, or those in transition.

Over the year, we’ve seen significant changes in premium costs and deductible structures. Group plans often have more stable pricing, while individual plans can vary widely based on market trends and personal factors.

Why Careful Evaluation Matters

Choosing the right plan requires weighing the benefits of each option. Group plans offer stability and affordability, while individual plans provide customization and flexibility. By understanding these differences, you can make a decision that aligns with your health and financial goals.

“The right health plan isn’t just about coverage—it’s about peace of mind and financial security.”

- Group plans are cost-effective but less flexible.

- Individual plans offer customization but may come with higher costs.

- Eligibility varies, so choose based on your employment status.

- Yearly changes in premiums and deductibles can impact your decision.

Cost Comparison: Premiums, Deductibles, and Out-of-Pocket Expenses

Understanding the financial aspects of health coverage is key to making informed decisions. Costs can vary significantly based on the type of plan you choose, whether it’s a group or individual policy. Let’s break down the numbers to help you see the big picture.

Average Premiums and Annual Contributions

In 2023, the average monthly premium for self-only coverage in group plans was $703, while individual plans averaged $456. Family coverage showed a similar trend, with group plans costing more but offering broader benefits. These numbers highlight the importance of evaluating your need for comprehensive coverage versus affordability.

Annual contributions also play a role. Group plans often split costs between employers and employees, reducing the financial burden. Individual plans, however, require full payment by the policyholder, though subsidies can help offset expenses.

Deductibles and Cost Sharing Explained

Deductibles are another critical factor. In 2023, the average deductible for individual plans was $1,945, while group plans averaged $1,644. Higher deductibles mean lower premiums, but more out-of-pocket expenses when you need care.

Cost-sharing mechanisms like copays and coinsurance also vary. Group plans typically have lower copays, making them more predictable. Individual plans may offer flexibility but can come with higher unexpected costs.

“The right plan balances upfront costs with long-term financial security.”

Here’s a detailed comparison of costs:

| Aspect | Group Plans | Individual Plans |

|---|---|---|

| Average Monthly Premium (Self-Only) | $703 | $456 |

| Average Deductible | $1,644 | $1,945 |

| Cost Sharing | Employer and employee contributions | Fully paid by the individual |

| Flexibility | Limited to employer options | Customizable to personal needs |

By understanding these details, you can make a choice that aligns with your financial and healthcare goals. Take the time to evaluate your options and find the best way to secure your well-being.

The Impact of Premium Contributions and Cost Sharing on Employees

Managing healthcare costs is a shared responsibility between employers and employees. Understanding how these costs are divided can help us make informed decisions about our coverage. Let’s explore how employer contributions and employee responsibilities shape our financial well-being.

How Employer Contributions Shape Our Costs

Employer contributions significantly reduce the financial burden on employees. In group coverage, employers often cover a substantial portion of premiums, making these plans more affordable. The size of the firm plays a role, with larger companies typically offering more generous contributions.

For example, in 2023, employees at large firms contributed an average of 17% of the total premium for single coverage. In contrast, small firms required employees to pay up to 27%. This difference highlights the importance of understanding your employer’s contribution model.

Understanding Employee Out-of-Pocket Responsibilities

While employer contributions lower premiums, employees still face out-of-pocket costs like deductibles and coinsurance. These expenses can vary based on the plan’s design and the employee’s income level. Lower-wage workers often feel the impact more acutely.

Marketplace conditions and eligibility for subsidies can also influence these costs. For instance, those who qualify for subsidies under the Affordable Care Act may see reduced out-of-pocket expenses, making individual plans more accessible.

“The right balance between employer contributions and employee responsibilities ensures affordable and comprehensive coverage.”

Here’s a comparison of cost-sharing arrangements:

| Aspect | Large Firms | Small Firms |

|---|---|---|

| Employee Premium Contribution | 17% | 27% |

| Average Deductible | $1,500 | $2,300 |

| Subsidy Eligibility | Rare | Common |

By understanding these factors, we can make choices that align with our financial and healthcare needs. Whether you’re part of a large or small firm, knowing your options empowers you to secure the best coverage for your unique situation.

Flexibility and Personalized Benefits in Individual Health Plans

Customizing your coverage can transform how you approach healthcare. Unlike group health insurance, individual health insurance plans offer the freedom to tailor benefits to your unique needs. This flexibility allows you to choose providers, adjust coverage levels, and align your plan with your lifestyle.

Choosing Your Preferred Providers and Plans

One of the standout features of individual health insurance is the ability to select your preferred providers. Whether you have a trusted doctor or need specialized care, these plans let you build a network that works for you. Group health insurance, on the other hand, often limits choices to predefined networks.

Here’s how the two compare:

- Individual Plans: Customizable coverage, provider freedom, and tailored benefits.

- Group Plans: Fixed networks, employer-driven options, and less personalization.

For example, if you have a chronic condition, an individual health insurance plan can be designed to cover specific treatments. This level of customization is rarely available in group health insurance.

“The right plan isn’t just about coverage—it’s about finding a solution that fits your life.”

Additionally, marketplace plans often come with subsidies, making them more affordable for those with lower incomes. This financial support can make individual health insurance a viable option for many families.

By taking a proactive approach, you can create a health insurance plan that meets your medical and financial needs. The flexibility of individual health insurance empowers you to make choices that benefit your long-term well-being.

Leveraging HRAs and Health Stipends: Saving on Your Health Costs

Maximizing your health benefits starts with understanding innovative tools like HRAs and health stipends. These options can significantly reduce your out-of-pocket expenses while enhancing your coverage. Let’s explore how they work and why they might be the perfect fit for your needs.

Exploring Qualified Small Employer HRAs and Integrated HRAs

Health Reimbursement Arrangements (HRAs) are employer-funded accounts that reimburse employees for medical expenses. They come in various forms, including Qualified Small Employer HRAs (QSEHRAs) and Integrated HRAs. QSEHRAs are designed for small businesses with fewer than 50 employees, offering a flexible way to provide health insurance policy benefits.

Integrated HRAs, on the other hand, work alongside group health plans. They cover expenses not included in the primary plan, such as deductibles or copays. Both options empower employees to manage their care more effectively while reducing financial strain.

How Health Stipends Enhance Personal Coverage

Health stipends are another powerful tool. Unlike HRAs, stipends are fixed amounts provided to employees to purchase their own insurance plan. This flexibility allows individuals to choose coverage that aligns with their unique needs, whether through marketplace plans or other options.

For example, a $200 monthly stipend can help offset premium costs or cover eligible expenses like prescriptions. This approach is particularly beneficial for those who prefer personalized coverage over employer-sponsored options.

“HRAs and health stipends are more than just benefits—they’re pathways to financial freedom and better health outcomes.”

Here’s a comparison of HRAs and health stipends:

| Aspect | HRAs | Health Stipends |

|---|---|---|

| Funding Source | Employer-funded | Employer-provided |

| Flexibility | Reimburses eligible expenses | Fixed amount for any health-related costs |

| Eligibility | Must be part of a group plan | Available to all employees |

By leveraging these tools, you can take control of your health expenses and secure the coverage you deserve. Explore HRAs and health stipends today to make your sponsored health insurance work harder for you.

Emerging Trends in U.S. Health Insurance: Future Insights

The landscape of health care is rapidly evolving, bringing new opportunities and challenges for everyone. As costs rise and technology advances, both employers and individuals are rethinking their strategies to ensure affordable and comprehensive coverage. Let’s explore the key trends shaping the future of health insurance in the United States.

Shifting Employer Strategies and Group Plan Dynamics

Employers are adapting to rising health care costs by reevaluating their contribution models. Many are increasing their share of premium contributions to retain top talent, while others are exploring alternative solutions like Health Reimbursement Arrangements (HRAs). These shifts aim to balance affordability with employee satisfaction.

Group plans are also evolving to include more preventive care options and mental health services. Employers are recognizing the importance of holistic well-being, which can lead to higher productivity and lower long-term costs. According to recent studies, firms with robust health benefits see a 20% increase in employee retention.

Innovations in Individual Health Insurance Offerings

On the individual side, the market is becoming more dynamic. Advances in technology are enabling personalized health care solutions, from telemedicine to wearable devices. These innovations are reshaping how we think about individual coverage, making it more accessible and tailored to each person’s needs.

Premium costs are also being influenced by these changes. While some plans are becoming more affordable due to subsidies, others are incorporating advanced treatments that may increase costs. It’s essential to stay informed about these trends to make the best decisions for your health and financial well-being.

“The future of health insurance lies in flexibility, innovation, and a focus on individual needs.”

Here’s a comparison of emerging trends in employer and individual plans:

| Aspect | Employer Strategies | Individual Innovations |

|---|---|---|

| Cost Management | Increased employer contributions | Subsidies and tax credits |

| Coverage Focus | Preventive and mental health care | Personalized and tech-driven solutions |

| Future Outlook | Holistic employee well-being | Affordable, tailored coverage |

By understanding these trends, we can prepare for the future and make choices that align with our health and financial goals. Whether you’re part of a group plan or exploring individual options, staying informed is the key to securing the best coverage for your needs.

Conclusion

Making smart choices about coverage ensures both financial stability and peace of mind. Throughout this guide, we’ve explored the critical differences between employer-sponsored and individual options, highlighting the importance of informed decision-making. Understanding factors like insurance premium costs, deductibles, and employee contributions empowers us to choose the best fit for our needs.

We’ve also examined how future trends are shaping the marketplace, from evolving employer strategies to innovative individual offerings. These insights equip us to navigate the complexities of coverage with confidence. Whether you’re balancing cost or seeking flexibility, the right choice can secure a healthier financial future.

Let this guide be your roadmap. Embrace the available options, and take control of your well-being. By making informed decisions, you can protect your money and ensure access to quality care. The journey starts now—choose wisely and thrive.